A Look Into The 2023 Corn Market

Oct 13, 2022

The corn market today is trading on two different sets of thought processes. The first is a supportive to bullish balance sheet. Ending stocks are estimated at 1.37 billion bushels from the USDA. This is a tight number with the type of demand we have experienced and the thought of less world competition due to the war in Ukraine. However, this low ending stock number depends on a continuing strong demand picture. The ethanol industry has been burdened with low oil prices and high inputs, but how long will they continue to produce ethanol with a negative profit margin?

Poor economics such as a higher U.S. dollar and higher interest rates typically have a negative affect on commodity prices. The December 2023 corn price is around 6.30 futures today, close to the highs we set back in April of this year. Bulls are pointing to the low stocks, dry conditions, and strong current demand. Bears are pointing at poor economics, questionable future demand, and the possibility of more acres planted this spring.

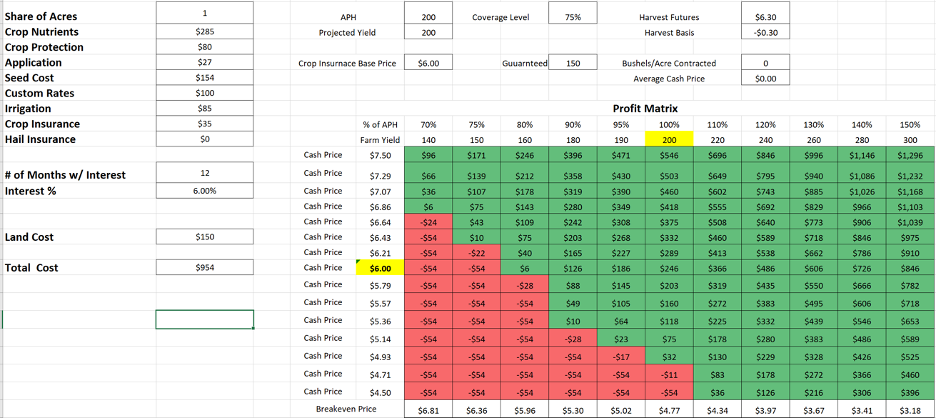

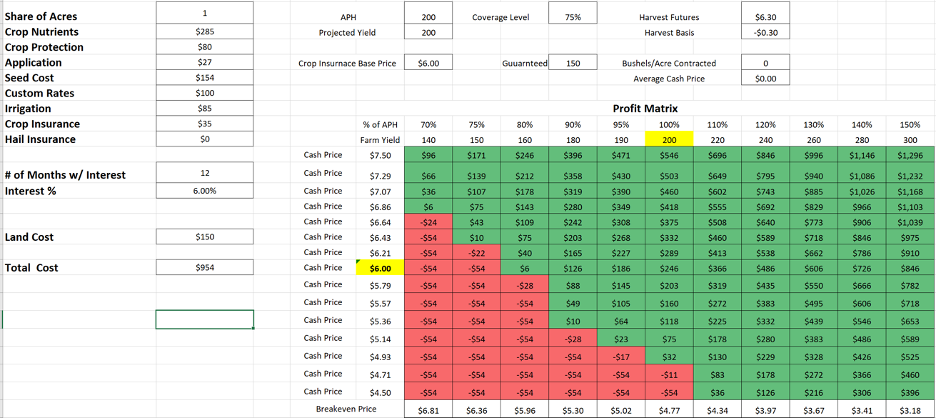

As we move closer to the end of the year and people are planning for next year’s fall crops, 2023 corn profitability looks very attractive. If we are managing inputs while we manage our outputs, there is an opportunity to lock on a great ROI. Below is a snapshot of 2023 irrigated corn with current prices levels. Keep in mind, total cost of production will differ according to the operation’s farming practices, but in this illustration, we are estimating total cost of production to be $954/acre and a net ROI of over 25%.

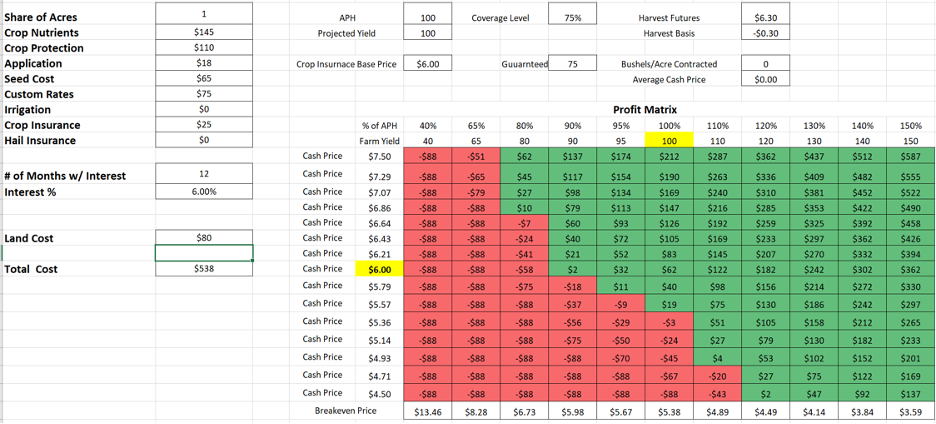

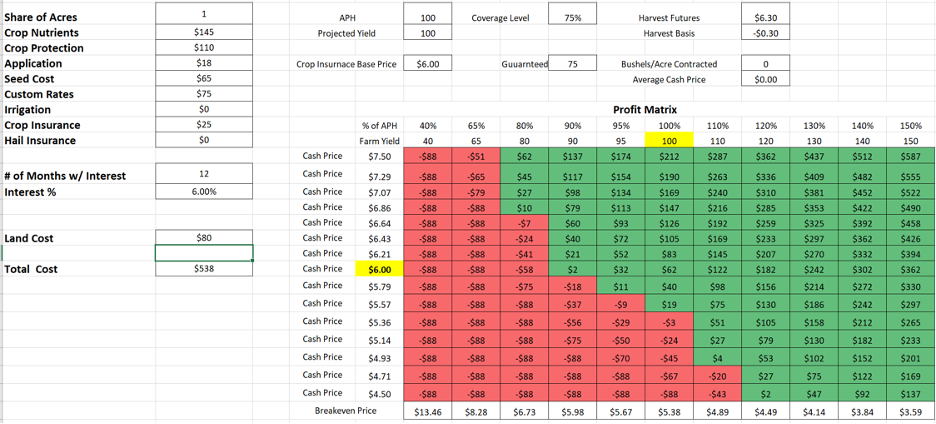

Here is another profit matrix example using dryland corn showing almost a 12% ROI using a cost of production of $538/acre and a yield of 100 bpa.

Producers growing corn in 2023 should take a hard look at what can be locked in for 2023. Even with higher input prices, net return to the farm looks very attractive. We had very low plantings in spring of 2022, so it’s possible this could be a repeat of the 2012-2013 crop years. In that crop year, we had dry conditions, high input prices, high crop prices, and profitability on corn looked attractive like it does today. In the spring of 2013, we planted over 97 million acres of corn and sent corn prices lower for many years after. Producers should be protecting these profit levels, and possibly implement a strategy to protect upside and stay flexible to protect the unknown.

Poor economics such as a higher U.S. dollar and higher interest rates typically have a negative affect on commodity prices. The December 2023 corn price is around 6.30 futures today, close to the highs we set back in April of this year. Bulls are pointing to the low stocks, dry conditions, and strong current demand. Bears are pointing at poor economics, questionable future demand, and the possibility of more acres planted this spring.

As we move closer to the end of the year and people are planning for next year’s fall crops, 2023 corn profitability looks very attractive. If we are managing inputs while we manage our outputs, there is an opportunity to lock on a great ROI. Below is a snapshot of 2023 irrigated corn with current prices levels. Keep in mind, total cost of production will differ according to the operation’s farming practices, but in this illustration, we are estimating total cost of production to be $954/acre and a net ROI of over 25%.

Here is another profit matrix example using dryland corn showing almost a 12% ROI using a cost of production of $538/acre and a yield of 100 bpa.

Producers growing corn in 2023 should take a hard look at what can be locked in for 2023. Even with higher input prices, net return to the farm looks very attractive. We had very low plantings in spring of 2022, so it’s possible this could be a repeat of the 2012-2013 crop years. In that crop year, we had dry conditions, high input prices, high crop prices, and profitability on corn looked attractive like it does today. In the spring of 2013, we planted over 97 million acres of corn and sent corn prices lower for many years after. Producers should be protecting these profit levels, and possibly implement a strategy to protect upside and stay flexible to protect the unknown.