Are You Staying Active In Your Risk Management Plan

Apr 14, 2023

Article by Scotty Yerges

The potential for the most combined planted acres of corn, beans, and wheat since 2014 (229.4 million), and very contradicting moisture stories across the country, have producers concerned with both upside and downside potential in the ag markets.

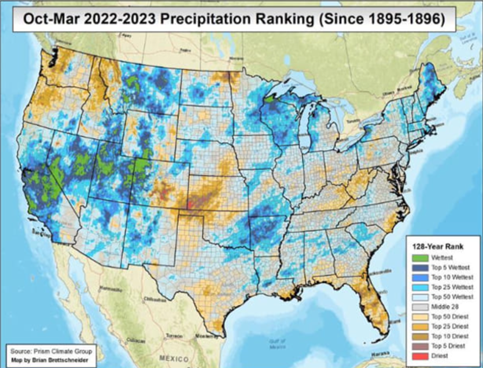

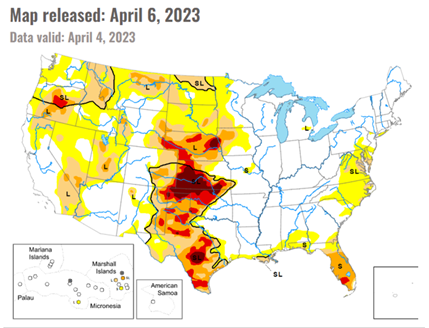

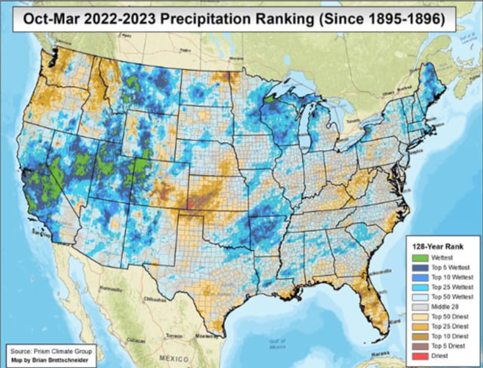

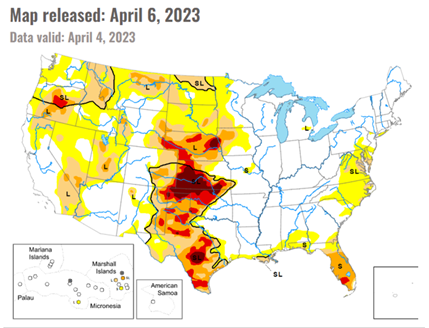

Wheat has been one of the hotter topics as of lately. Current wheat stocks are not nearly as tight as the corn and bean picture, but drought has raised many concerns in our area. I think the two drought monitors below sum it up perfectly……

In the western region of our footprint, wheat has a severe problem and we have been managing our way through current positions to make sure that we are still on pace with the expected lower production. In the central part of our territory, wheat is hanging on. We have potentially taken the top end off, but if we catch some rains in the near future, we still could have an average crop. We recommend that producers take a good hard look at their current risk management program. Where does your risk lie? Is it in positions that you already have on and you need to manage upside? Or is your farm’s wheat crop still in good shape and you need to have more floors in place in case something changes.

On the other side of the coin, it is easy to look out our back door and develop a one-sided perception. Let’s entertain some potential numbers for fall corn production….

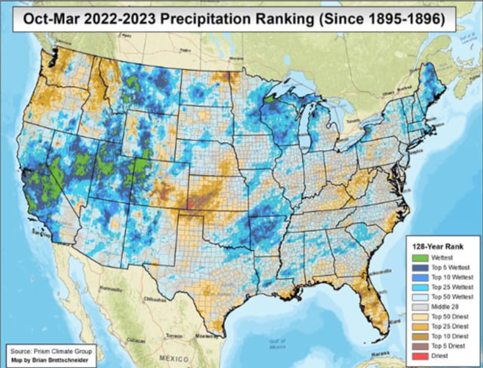

This puts us at a potential of a 2-billion-bushel 23-24 carryout. This is in no way predicting price, but last time we were there, we were closer to $4 futures or lower. We are dry in our area, Texas and Oklahoma panhandle, but as the drought monitor shows, the corn belt is in very good shape when it comes to moisture. Some are concerned about too much moisture for planting, but history has shown us that more rain is better than not enough.

What should you be doing?

The potential for the most combined planted acres of corn, beans, and wheat since 2014 (229.4 million), and very contradicting moisture stories across the country, have producers concerned with both upside and downside potential in the ag markets.

Wheat has been one of the hotter topics as of lately. Current wheat stocks are not nearly as tight as the corn and bean picture, but drought has raised many concerns in our area. I think the two drought monitors below sum it up perfectly……

In the western region of our footprint, wheat has a severe problem and we have been managing our way through current positions to make sure that we are still on pace with the expected lower production. In the central part of our territory, wheat is hanging on. We have potentially taken the top end off, but if we catch some rains in the near future, we still could have an average crop. We recommend that producers take a good hard look at their current risk management program. Where does your risk lie? Is it in positions that you already have on and you need to manage upside? Or is your farm’s wheat crop still in good shape and you need to have more floors in place in case something changes.

On the other side of the coin, it is easy to look out our back door and develop a one-sided perception. Let’s entertain some potential numbers for fall corn production….

- 92 million acres of corn (USDA’s number on the March 31 planting intentions report)

- Trendline yield is 181bpa (let’s use 179)

- Annual usage of 14.5 billion

This puts us at a potential of a 2-billion-bushel 23-24 carryout. This is in no way predicting price, but last time we were there, we were closer to $4 futures or lower. We are dry in our area, Texas and Oklahoma panhandle, but as the drought monitor shows, the corn belt is in very good shape when it comes to moisture. Some are concerned about too much moisture for planting, but history has shown us that more rain is better than not enough.

What should you be doing?

- Stay active in your risk management plan.

- Take a look at what you have done for this fall and have some targets in place to lock in more sales.

- Take some time and look at crop rotations and potential production for 2024.