Market Outlook

Jan 13, 2023

Corn bulls got a big surprise with the January USDA supply and demand report. The U.S. production was lowered by 200 million bushels and ending stocks lowered 15 million bushels. The USDA also lowered Argentina and Brazilian expected corn production. Argentina has been dry and if they do not get rain, their crop could keep getting smaller. Global ending stocks were also lowered in the January report.

On the bearish side, demand was cut across the board. Exports were lowered by 150 million bushels and even domestic use was lowered by 10 million bushels. Going forward the fear is a weakening economy and with the drought we have had the last couple years, our livestock numbers are lower leading to less feed usage.

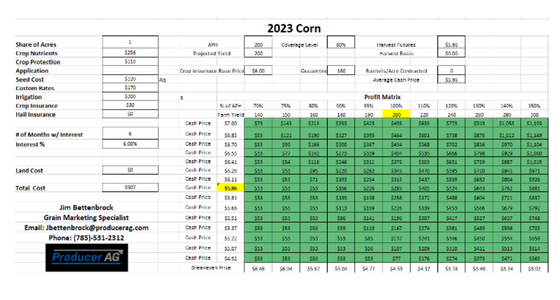

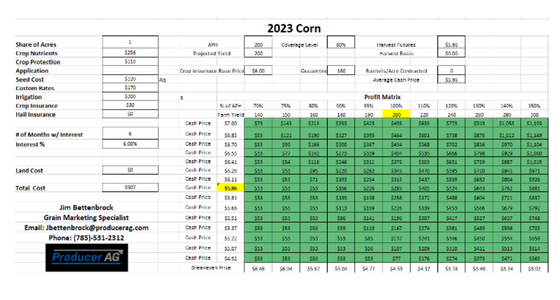

Growers growing irrigated corn in 2023 are profitable at current prices. As you are buying your inputs for the new crop this spring, you need to be managing the profit potential and stay flexible.

On the bearish side, demand was cut across the board. Exports were lowered by 150 million bushels and even domestic use was lowered by 10 million bushels. Going forward the fear is a weakening economy and with the drought we have had the last couple years, our livestock numbers are lower leading to less feed usage.

Growers growing irrigated corn in 2023 are profitable at current prices. As you are buying your inputs for the new crop this spring, you need to be managing the profit potential and stay flexible.